View historical precious metals price charts »

View historical precious metals price charts »

- June 19, 2017 -

Donald Trump’s policy agenda, and his very presidency, are in jeopardy…at least if you believe all the chatter from the left-leaning “mainstream” media.

For weeks now, the big media outlets have been stirring up talk of impeachment. One story after another dealing with the likes of James Comey, Jared Kushner and Vladimir Putin are behind the impeachment talk despite the lack of concrete evidence of “high crimes and misdemeanors.”

Still, Democrats in Congress smell blood in the water, and they have readied articles of impeachment for introduction as soon as an opportunity presents itself.

But investors don’t seem particularly concerned about the implications of intensifying political turmoil in Washington.

The traditional safe-haven of gold is up modestly on the year but has yet to see any major sort of panic buying.

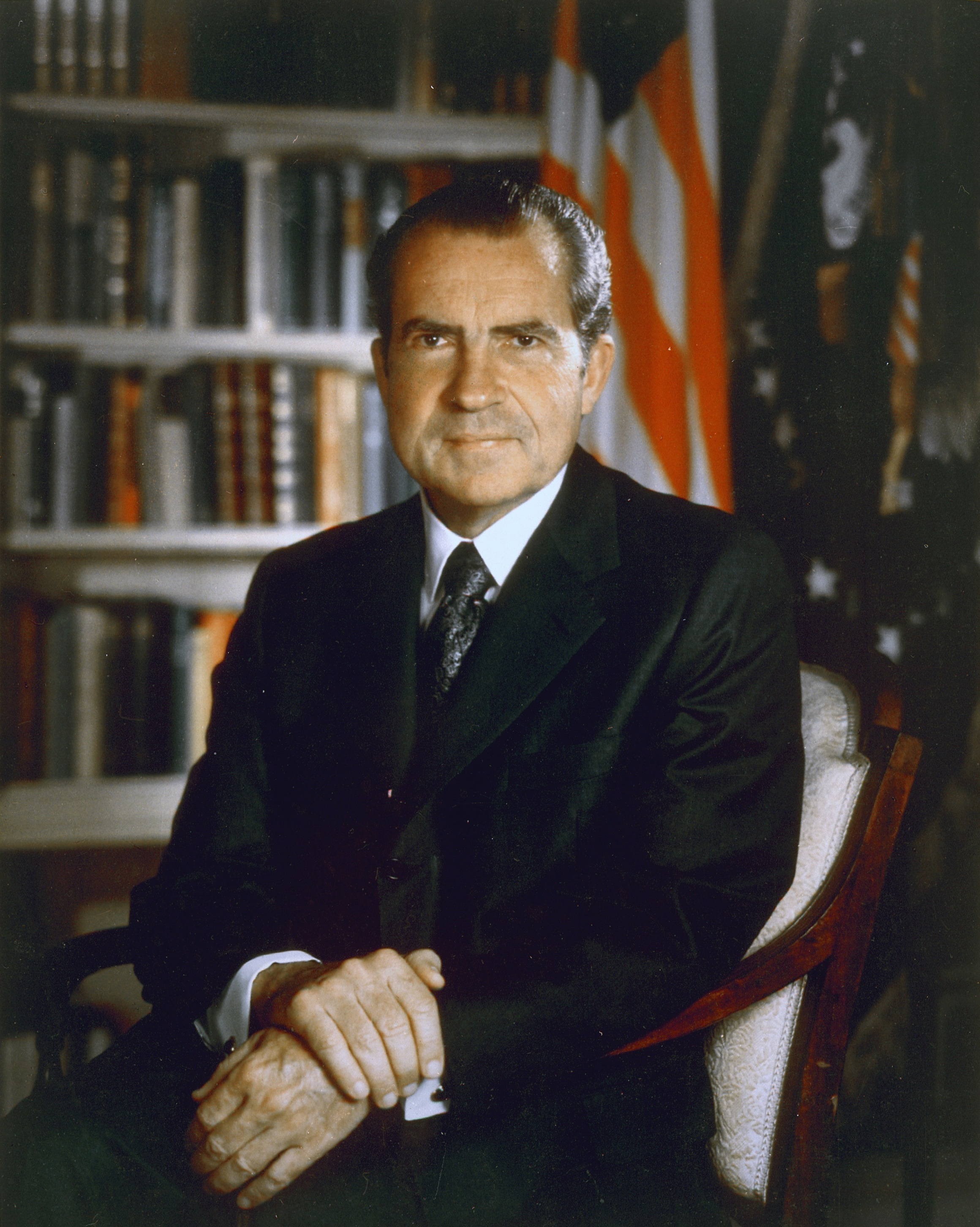

Precious metals markets so far have not been affected by the possibility of a President Trump impeachment or resignation. [CC BY-SA 2.0], via Wikimedia Commons]

Consider the recent history of presidents who have gotten themselves into trouble.

Neither the resignation of Richard Nixon nor the impeachment (and subsequent acquittal) of Bill Clinton caused a stock market crash. Precious metals markets also showed little volatility around these momentous political events.

President Nixon resigned in August of 1974 with gold trading at $152.00 an ounce. Gold began that year at $117.00 and finished at $195.00 per ounce.

Nixon’s resignation occurred within a year-long rally and does not seem to have altered its trajectory.

Far more significant than Nixon’s resignation was his decision in August of 1971 to close the gold window.

From that point on the U.S. dollar would be a fiat currency with no link to gold.

The resignation of President Nixon had little effect on the economy compared to his decision to close the gold window.

As a consequence, inflation fears began to build, slowly at first, but then manically by 1980 with gold prices spiking to $850.00 an ounce.

The Watergate scandal that made Nixon infamous did not really have anything to do with how precious metals performed in that era. The real Nixon legacy is what happened to the dollar after he ended its ability to be redeemed in gold, the consequences of which are still playing out.

Contrary to popular misconceptions, Nixon was never impeached. But Bill Clinton was.

The House of Representatives initiated articles of impeachment against President Clinton in December of 1998. However, in February of 1999 the Senate voted to acquit Clinton and leave him in office.

Around that time gold prices were in a long bottoming out process after having been in a bear market since January 1980. From the time Clinton was impeached to his acquittal, gold essentially did nothing but remain stagnant in the $290.00 range.

The bottom line is that political turmoil, in this case a possible Trump impeachment or resignation, does not necessarily translate into market turmoil or even a detectable reaction.

But major policy changes can have significant short term and long term effects on precious metal markets.